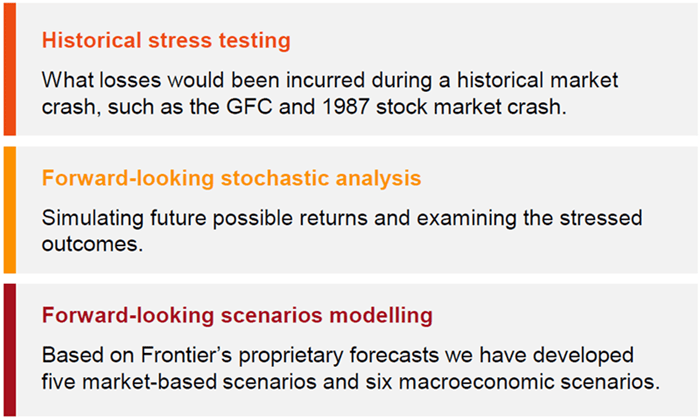

As any investment history buff will tell you, market stress periods occur more frequently than standard economic models predict. Be it the COVID-19 pandemic or the black swan financial crisis of 2008, investors need to build portfolios that are resilient to these market crashes.

As part of SPS530, APRA requires superannuation funds to have a comprehensive investment stress testing program that is approved by the Board. This program must include adverse stress scenarios covering a range of factors that can create extraordinary losses. The testing program must be undertaken at least annually and needs to have clearly articulated stress testing objectives, methodology, assumptions, frequency and risk factors, including the rationale for the severity of the adverse stress scenarios.

Frontier Advisors helps our clients to stress test their portfolios by undertaking:

In recognition of the changing investment environment and the implications of regime turbulence for expected portfolio outcomes, we have made a number of major enhancements to our Portfolio Analytics modelling capability. Thanks to the dedicated efforts of our capital markets team on regime risk client-driven projects, our in-house quantitative work on regimes and our commitment to developing a user-friendly interface, we are pleased to announce several new enhancements:

- A new historical stress scenario was added this year, the 2020 COVID-19 pandemic stressed scenario.

- The addition of non-normal modelling capability to our stochastic analysis to more easily reflect the real-world behaviour of capital markets. Frontier’s skew and kurtosis parameters are now pre-loaded. Users can easily rely on the parameter estimates from our Capital Markets and Asset Allocation Team (CMAAT). One click will load these estimates across all available asset class, allowing for more immediate modelling that considers non-normality in investment market distributions.

- Multi-regime path modelling has been added as a completely new capability within our Portfolio Analytics simulator. Users can now undertake advanced scenario analysis by considering shifting macroeconomic regimes over forecast horizons and visualise multiple regime paths in the same view, for strategic, actual or potential asset allocations.

Multiple assumption set modeling is now available across the entire Portfolio Analytics application. Additionally, usability and reliability have been enhanced by reducing user complexity in configuration. This more seamless configuration process provides efficiency benefits for users.

Learn more

To find out more about more about our latest stress and scenario testing capability or for training on our Portfolio Analytics tools please contact your client team or the Partners Platform team on pp@frontieradvisors.com.au.