Frontier Advisors and Context Capital have established a strategic partnership, combining Frontier Advisors’ institutional-grade independent investment research and advice with Context Capital’s expertise in partnering with independent financial advisers and delivering effective portfolio implementation.

This model offers institutional asset owners without custodian access, and private wealth clients, the opportunity to access tailored investment solutions through platforms, without giving up the benefits of conflict-free advice.

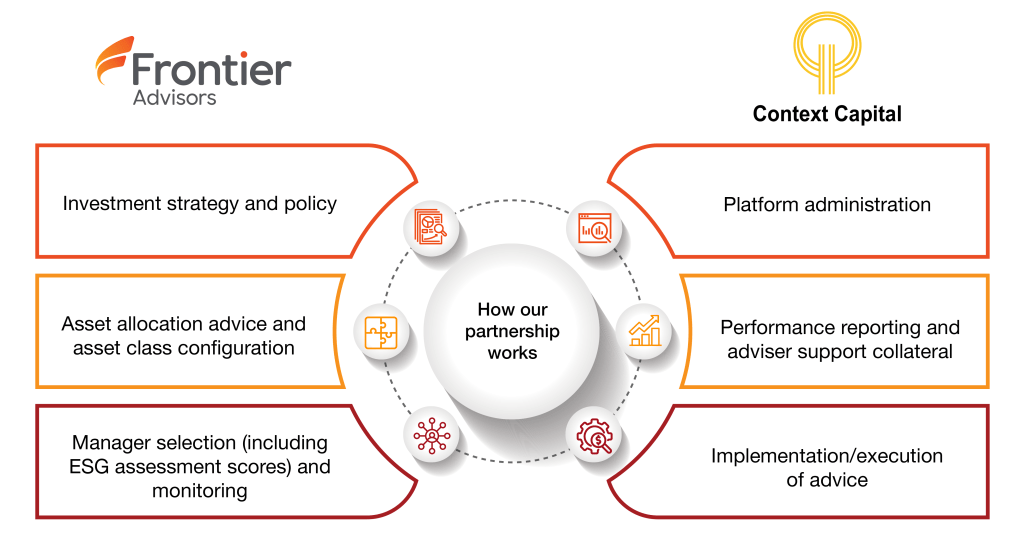

How it works

Investment advice

Frontier Advisors provides market-leading and unconflicted investment advice, backed by three decades of experience advising some of Australia’s largest institutions.

Implementation expertise

Context Capital brings extensive experience in implementing advice, with deep knowledge of platform mechanics and the wealth sector.

Compliance and governance

The external oversight and separation of duties by Context Capital adds an additional layer of rigour and protection for clients, safeguarding their interests.

How we work with clients

We tailor our services and advice to meet the needs of each client. Representatives from Frontier and Context collaborate closely, attending investment committee meetings to present and discuss portfolio recommendations.

An example of how responsibilities are typically divided between Frontier and Context for a client:

The benefit for clients

The Frontier-Context partnership separates investment advice from implementation, ensuring a truly client-focussed approach. While combining both services under one consultant may seem efficient, it can lead to internal incentives to direct clients to the consultant’s own products or platforms, generating more revenue for the consultant and prioritising their interest over the client’s. With no commission or fees received from products or implementation options, Frontier and Context ensure our partnership remains fully dedicated to achieving the best outcomes for our clients.

By eliminating these conflicts of interest and maintaining complete transparency, we empower clients to make well-informed decisions while retaining full flexibility over their investments. Clients benefit in the following ways:

Avoid conflicts of interest

Advice and implementation are not biased toward the consultant’s own products. Neither Frontier nor Context receives remuneration from any products or platforms. This ensures all recommendations are solely focussed on delivering the best-fit solutions for our clients.

Transparent fees

Clear and separate fee disclosure for investment advice and implementation helps clients understand all the fees they are paying, and to who, in order to make informed decisions and reduces complexity, while ensuring the use of two providers does not result in higher fees.

Enhanced governance and compliance

Context being a separate implementation provider adds a layer of governance by reviewing investment advice objectively, ensuring alignment with the investment policy and mitigating internal bias.

Improved client portability

Clients can select the external platform of their choice to suit their needs, making transitions to new structures or platforms smoother and more flexible.

Types of clients we work with

Private wealth

Mid to large independent financial advisory firms and family offices with a focus on independence and objectivity.

Endowments and foundations

Mid-sized endowments, including universities and not-for-profits, who do not have access to large custodians but require customised solutions.

Interested in learning more?

Get in touch at busdev@frontieradvisors.com.au if you are interested in:

- Learning more about the benefits of separating portfolio advice from implementation.

- Learning more about whether your organisation could benefit from the partnership.

- Understanding the trends we are seeing in the market, and how we can mutually support clients.