Global equities

With the turn of the year, asset owners and investment managers will be hopeful 2025 marks a turning point in the fortunes of global active management.

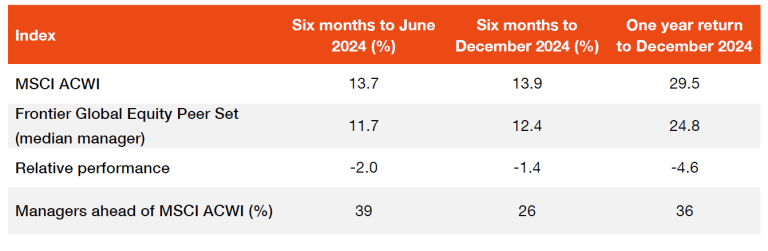

The continued narrow markets across most of 2024, led to a continuation of headwinds for all but a select group of active managers. In previous versions of our active management commentary, there were select periods over a 12-month span that provided some relief for active managers. However, the 2024 calendar year offered no such conditions. With the Mag-7 grabbing most of the headlines over the year, managers who did not hold Nvidia faced a 3.1% headwind alone. While the MSCI ACWI benchmark returned 17.5% (in USD) in 2024, the median stock return was less than 1%, highlighting the level of market concentration. This led to the worst outcome for global active managers relative to the MSCI ACWI benchmark (at the median level) in well over 20 years. The table below summarises active management results in global equities.

Frontier Global Equity Peer Set returns against the MSCI ACWI

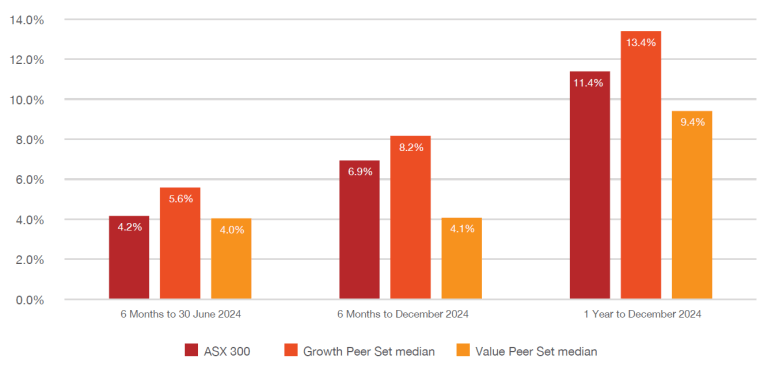

Breaking down these results across style, we saw an outperformance of growth managers across the first six months to June, though the second half proved more challenging with the median growth manager lagging the benchmark. The excess returns delivered over the year by the median manager in Frontier’s combined growth peer set in many ways hides the challenges faced by individual managers. Despite the outperformance of the growth factor, moderate growth managers who tend to display higher levels of valuation sensitivity (relative to high growth managers) lagged the benchmark over both the first and second half of the year, leading to a 3.7% underperformance (at the median level) over the calendar year.

As expected, value managers had an extremely tough year relative to global benchmarks. The brief market rotation in the September quarter, following a partial unwind of the Yen carry trade, gave some joy to both moderate and deep value managers in an otherwise challenging year. Overall, value managers underperformed in both the first and second half leading to the median value manager in Frontier’s combined value peer set underperforming by over 7% in the calendar year. None of Frontier’s five style peer sets (High Growth, Moderate Growth, Core, Moderate Value and Deep Value) managed to outperform the benchmark in the second half (at the median level), underscoring just how difficult an environment it was for active management in global equity markets.

Growth and value cohort returns in global equities

Australian equities

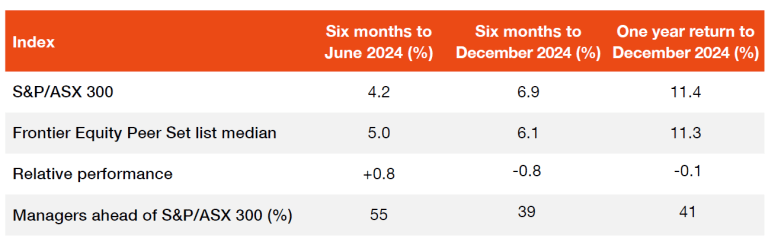

The 2024 calendar year was a modest year for Australian equity managers as well, with the median manager in Frontier’s Australian Equity Peer Set slightly underperforming the S&P/ASX 300.

While the concentration in global equity markets seemed to grab all the attention over the year, Australian managers faced the same headwinds in local markets. The modest absolute returns for the benchmark over the calendar year hid underlying variability between the performance of key index constituents and sectors in the Australian market. A positive start to the calendar year from managers was not sufficient to overcome a challenging end to the year.

Frontier Australian Equity Peer Set performance against S&P/ASX 300

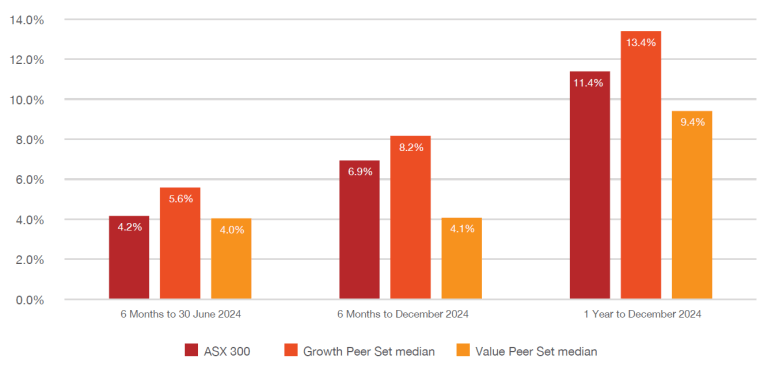

The chart below shows growth managers in Australian markets enjoyed a more productive calendar year than their value counterparts, outperforming the S&P/ASX 300 benchmark by 2.0% relative to a 2.0% underperformance for value managers. The underperformance of value managers predominantly occurred during the second half of the year with only a small level of underperformance in the first half. Growth managers delivered solid gains in the first half of the year, with a slight moderation in the gains against the benchmark in the second half.

Growth and Value Peer Set returns in Australian equities

The final word

The 2024 calendar year represented a challenging year for active managers in both Australian and global equity markets. The underperformance of the median manager in Frontier’s Global Equity Peer Set over the past 12 months was the most significant calendar year in over 20 years.

Barring a brief change in market leadership in the September quarter, there was no reprieve from the highly concentrated global equity markets that managers struggled to contend with. One bright spot in the global active management community was the performance of quantitative managers, whose explicit risk controls around factors such as currency, country and sector biases as well as exposure to factors such as quality and momentum enabled them to successfully navigate the challenging markets. Australian managers suffered a similar fate, though not to the same magnitude. Market leadership which centred around the big four banks led to the median manager in Frontier’s Australian Equity Peer Set to record a slight underperformance relative to the S&P/ASX 300 Index.

This paper serves as a reminder to investors that active management is cyclical (though it may not feel that way for investors in global equity markets currently!). We also highlight factors beyond traditional style biases affect performance relative to equity benchmarks. Frontier believes it is important to assess individual active management performance not only against style peers, but equally against a whole other range of factors (market breadth, country/sector leadership and size impacts) which ultimately can impact benchmark relative outcomes.

Our Equities Team is available to discuss our curated peer set service in more detail with interested clients. If you want to discuss this paper in more detail, please reach out to your consultant or a member of Frontier’s Equities Team.