Global equities

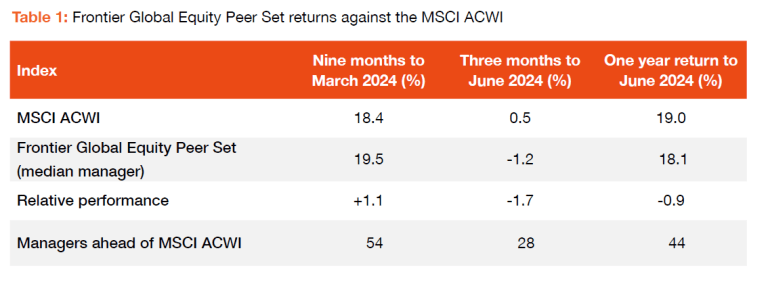

The 2024 financial year was marked by a return to challenging market conditions similar to those seen in 2020 and 2021. The previously popular group of ‘FAANG’ stocks evolved into the ‘magnificent seven,’ a shift that continued a trend of narrow market leadership and posed significant hurdles for active managers. Although global managers managed to post solid gains against the MSCI ACWI during the first nine months of the year, a terrible June quarter wiped out these gains. The results from this period, as shown in Table 1, highlight the tough environment for active management.

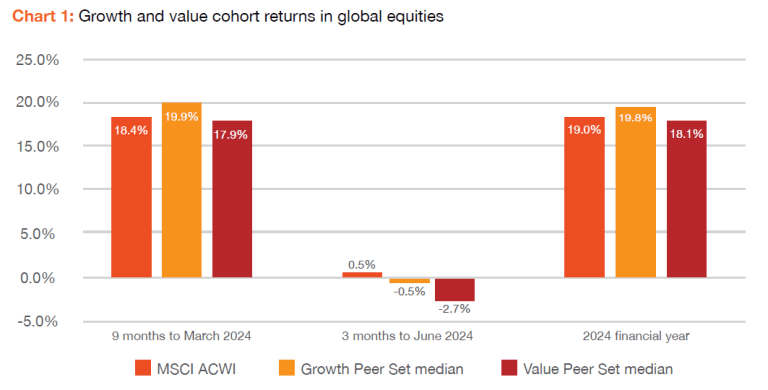

Within this landscape, growth managers generally performed well, surpassing the benchmark in both the first nine months and the full financial year. However, moderate growth managers, who are more sensitive to valuation changes, lagged behind. On the other hand, value managers had a tough year. They modestly underperformed in the initial nine months and faced steep challenges in the June quarter, which led to underperformance over the entire year. The June quarter was particularly challenging for growth and value managers alike, with only high growth managers able to outperform over this period underscoring just how challenging an environment it was.

The Global Core Peer Set revealed an interesting dynamic, with a stark contrast in performance among different strategies. Quantitative managers had an exceptional year, outperforming the MSCI ACWI by 5.9%, benefiting from their inherently risk controlled investment processes, such as sector and country neutrality. Meanwhile, discretionary managers struggled unable to navigate the high market concentration effectively. The period of high stock dispersion and low pairwise correlations in global markets generally favoured quantitative strategies, as they could leverage these factors to their advantage.

Australian equities

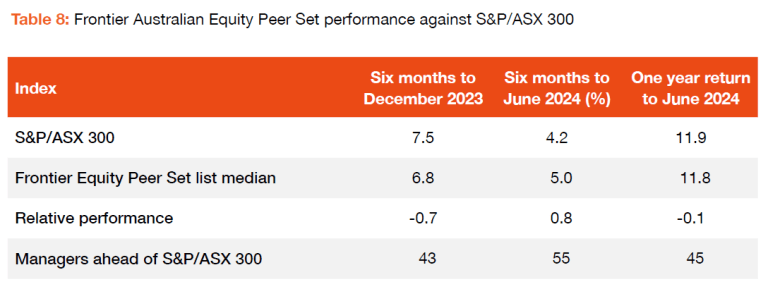

The Australian equity market mirrored the global trend, with active managers also facing a tough year. The median manager in Frontier’s Australian Equity Peer Set underperformed the S&P/ASX 300, marking the first financial year of underperformance since 2019. Despite a more promising second half of the year, the damage done in the first half proved too significant to overcome.

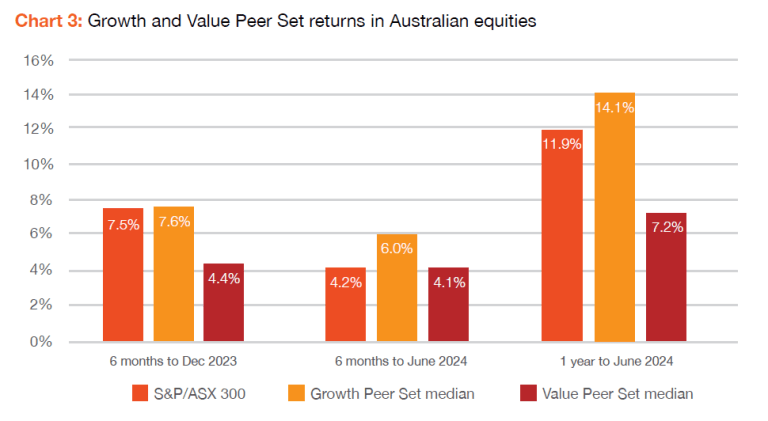

Growth managers in Australia had a somewhat better year compared to their value counterparts. They outperformed the S&P/ASX 300 by 2.2%, benefiting from an improved performance in the second half of the year. Conversely, value managers, who faced a challenging first half, saw some recovery in the latter part of the year but still ended up underperforming by 4.7%.

The final word

The 2024 financial year was particularly arduous for active managers in both global and Australian equity markets. The severe underperformance in the June quarter resulted in the worst quarterly excess return for global managers in over a decade. However, quantitative managers emerged as a bright spot, thanks to their effective risk controls. Australian managers also faced difficulties, with the big four banks’ dominance leading to significant underperformance for the median manager.

This year serves as a reminder of the cyclical nature of active management. It emphasises the importance of assessing performance not just through traditional style biases but also by considering factors like market breadth, sector leadership, and size impacts, all of which can significantly influence benchmark-relative outcomes.

Learn more

Frontier curates granular style-based peer sets in both Australian and global equity markets to better understand active management outcomes for clients, while also taking into account the prevailing market environment. Through the elimination of duplicates and rigorous analysis of the underlying manager constituents to ensure correct style classification, we believe these curated lists and the underlying peer set performance provide investors with greater insight into the performance of their active managers. These cohorts exist at a more granular level than what is presented in this paper.

Our Equities Team is available to discuss our curated peer set service in more detail with interested clients. If you want to discuss this paper in more detail, please reach out to your consultant or a member of Frontier’s Equities Team.