Portfolio modelling under different macro regimes

Market experience has shown that economic conditions are constantly changing. Frontier Advisors’ Research Team has produced an advanced modelling framework that seeks to better reflect a diverse range of economic environments or regimes. This allows for more nuanced portfolio modelling by examining how asset returns behave differently under different macro environment as well as the effect of macro environment on modelling portfolio outcomes.

We introduce a set of pre-defined regimes of inflation and GDP growth and introduce a new portfolio modelling approach that utilises regime pathways and Monte Carlo simulations.

The analysis of economic regimes is particularly important for investors, as it can help them identify which asset classes are likely to perform well under different economic conditions. The analytical framework based on regimes holds significant potential for a wide array of applications, including future analysis, historical review, and forward projection scenarios.

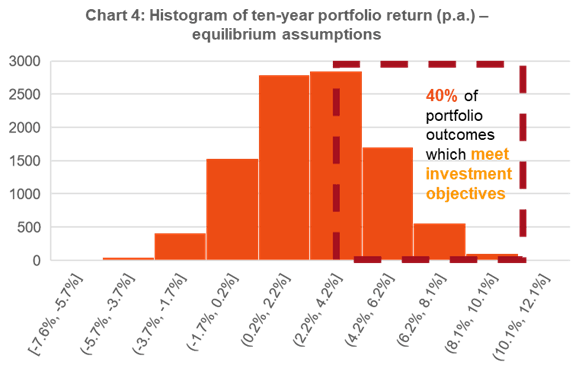

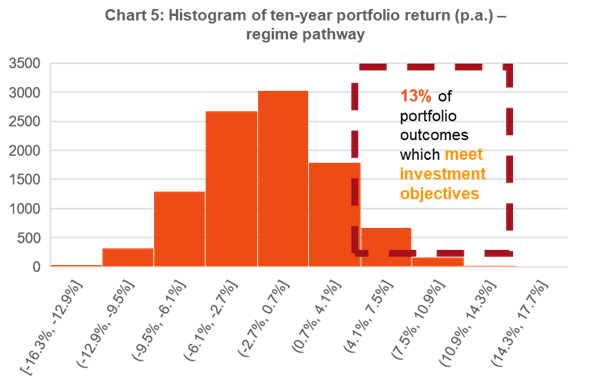

Simulation outcome

Accounting for asset returns under different macro environments changes portfolio modelling outcomes

- Enhanced portfolio modelling and risk management: Economic regime analysis allows clients to tailor simulations to their expectation of future economic conditions. This can assist with better understanding in potential portfolio performance and risk.

- Tailored strategies and diversification: Integration of potential future economic outcomes may allow for development of tailored investment strategies, considering macroeconomic conditions, and diversify their portfolios effectively to reduce concentration risk.

- Dynamic decision-making and scenario analysis: Simulations can be re-run as future expectations of economic conditions change. This can assist with dynamic and strategic decision-making.

- Broader long-term planning: Clients can run multiple different scenarios over varying time periods to explore a range of implications of current and long-term portfolio allocations.

This regime modelling is available for clients of Frontier Advisors interested in extended customised modelling, providing a comprehensive understanding of market dynamics and aiding in more informed decision-making.

Want to learn more?

This is a summary of a detailed paper issued to our clients. Please reach out to Frontier Advisors to discuss the full report or any questions you may have.