The Australian healthcare real estate sector, while becoming increasingly institutionalised over the past five to ten years, is still considered nascent compared to other developed regions like the US, UK, and Eurozone. This presents both opportunities and risks for investors. The industry grapples with several challenges, some of which are common to other real estate sectors, such as escalating construction costs, higher interest rates, and stringent financing conditions. However, there are also factors unique to this sector, including lower operator profits, evolving patient expectations, changes in healthcare delivery, technological advancements, and uncertain government funding and policies.

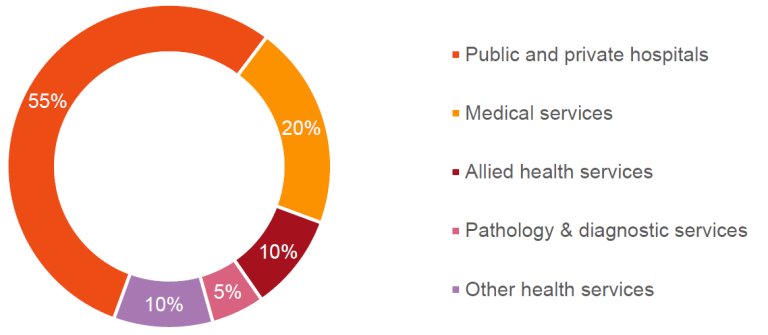

The Australian healthcare real estate market is currently valued at approximately A$155 billion, with A$22 billion of this being securitised. The main market participants are REITs, which typically invest in large-scale projects; private investors and syndicates, who favour investing in smaller medical centres and diagnostic and pathology centres; and owner occupiers.

Australian healthcare property opportunity set (November 2023)

Healthcare real estate is the largest investable niche sector in Australia. While asset types are diverse and cater to a variety of investors, we summarise the key risks and opportunities in the main subsectors for institutional investment.

- Private day and/or specialised hospitals: Risks include government funding challenges, difficulties in converting to alternate uses, staffing issues in high-need specialisations, and challenges with private health insurance in some specialties. On the flip side, they present opportunities such as lower operating costs, the ability to identify specialisation needs in different trade areas, potential for co-location with overnight hospitals and consultation rooms, and the possibility of securing private health insurance funding above default rates.

- Private overnight hospitals: Like private day and specialist hospitals, private overnight hospitals not only grapple with government funding challenges, but additionally, a limited pool of tenants, risk of redundancy, a costly operational model, and lease structures that generally favour operators. However, they also present opportunities due to the short supply of beds, potential for development, partnership and co-location opportunities with public hospitals, education, housing, and the fact that they have very sticky tenants.

- Life sciences sector: Still emerging in Australia, this sub-sector faces risks such as limited government funding, limited venture capital funding, co-location challenges, limited tenant options, and fragmentation with low stock availability. However, it also offers stable income profiles with CPI+ or fixed rental increases and partnership and co-location opportunities with public hospitals, education, housing.

- Medical centres: This sub-sector faces challenges in building scale, government funding challenges, resourcing and staffing challenges, risk of technology obsolescence, and locational bias. However, they also present portfolio opportunities, a need in metropolitan, suburban, and regional areas, diversification benefits, and ease of conversion to alternate uses.

- Aged care facilities: The sub-sector face high reputational risk, funding challenges, staffing challenges, limited tenant options, and rent increases limited to CPI. However, they are cheaper to operate, similar to residential facilities, and are easy to convert to alternate uses.

Our comprehensive paper delves into key investment characteristics for investors to consider, how to access investments in these sub-sectors, and Frontier’s view. It also examines demographic trends and government funding sources, which are key factors influencing the investment proposition for the healthcare real estate market in Australia. The paper highlights the impact of population growth, demand for tertiary education, and government support for the market, and discusses the role of AI and technology in shaping the future of the sector.

Frontier continues to have conviction in needs-based real estate sectors for client portfolios, with the healthcare sector being one of the preferred sectors. Despite short-term challenges, Frontier maintains selective confidence in the healthcare sector, suggesting that healthcare investments can complement traditional real estate due to different return drivers. We also recommend the use of specialist healthcare managers for capital allocation in this sector.

In Part-two of this series we will delve into past performance, key metrics, typical leases and real estate supply and demand.

Want to learn more?

If you have any questions or want to access the full paper, please contact us. Frontier clients can access the comprehensive research paper instantly on Frontier’s Partners Platform.