Manager Insights launch

In March 2023, Frontier Advisors’ Partners Platform achieved two significant milestones.

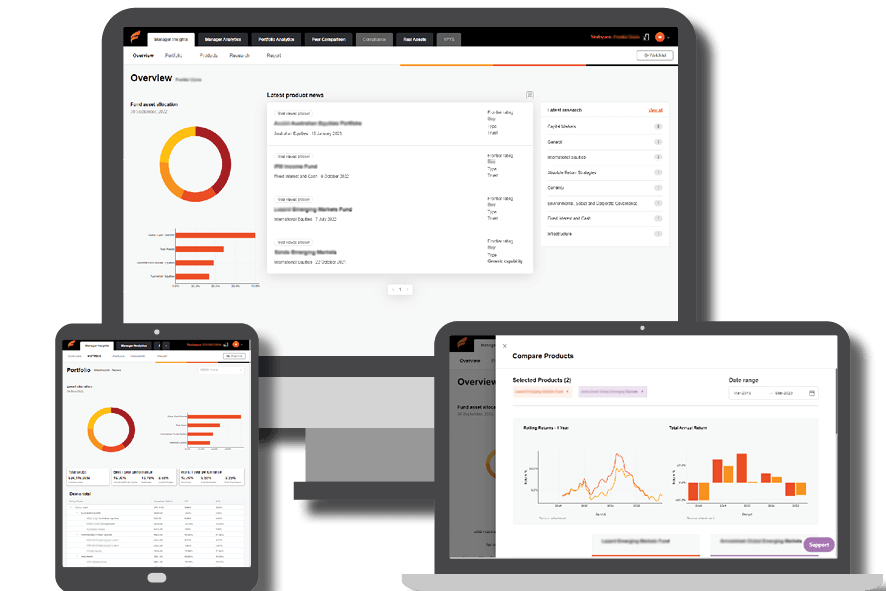

Manager Insights is the latest generation of our interactive manager research solution for investment professionals. Manager Insights replaces the previous Mercury product, retaining the same content and functionality users are familiar with but with exciting upgrades that provide more profound insights and a better user experience.

Manager Insights provides access to Frontier Advisors’ extensive, conflict free manager research.

- With approximately 3,400 investments products, from over 1,500 investment managers, to easily filter through, on key product characteristics, classifications and ratings.

- With specialist sector research and ratings delivered by Frontier Advisors’ equities, alternatives and derivatives, real assets, private markets and debt and currency teams.

- Allowing asset owners to consider views and ratings on 1,300 products, and the ability to access in-depth ratings for approximately 450 Frontier rated products.

- Driven by 1,700 manager research pieces annually and complemented with the ability to access detailed portfolio construction and capital markets insights.

At the same time, we also launched Partners Platform 2.0. The platform offers a single sign-on (SSO) that integrates all our technologies in one view, providing our clients with an intuitive and streamlined experience. For example, asset owners can test multi-asset portfolio asset allocations versus SAA, compare key performance metrics against peers and conduct deal-level analytics on real assets portfolios.

Frontier has been at the forefront of delivering investment advice and technology to institutional investors for more than 25 years. We are proud to retain our top ranking as a leader in quality digital analytics and research tools in the 2023 Peter Lee Associates independent survey, which reflects our commitment to continuously developing and enhancing our technology to increase value to asset owners.

Get in touch with your Frontier client team or pp@frontieradvisors.com.au to schedule a demo or to find out more about our manager research coverage.

Selecting manager research technology

Manager research technology is essential in supporting the monitoring and selection of investment manager products. But what considerations should asset owners make when selecting the best fit technology for their needs?

Here are three considerations worth asking vendors when searching for the right solution for your needs:

How does your manager selection journey begin?

Does your process rely on an external consultant to deliver a shortlist of suitable candidates, or is quantitative screening on a broad universe the starting point? Does your investment governance framework require ‘rated’ investment management products, for example?

Here, having the right breadth or depth of information to hand is important, along with considering whether product coverage in manager research data can provide investable ideas relevant to your portfolio construction framework. The requirement for a rating may help narrow down the list of providers, however it is always worth understanding the breadth and depth of the research team and the true level of independence of the research house, particularly from conflicted revenues.

When a shortlist of candidates is created, either internally or with external consultant support, what type of qualitative information will best support your search process?

Manager research technologies can provide the research ‘IP’ of professional and experienced manager researchers, such as manager meeting notes, detailed investment product reviews, manager assessments, fee considerations and ESG considerations. Alternatively, some technology vendors may provide generic questionnaire data, which may support asset owners in developing further questions to ask asset managers. Ultimately, the type of qualitative information required can depend on resourcing, the need for some level of external assurance, or even a second opinion on an incumbent consultant’s recommendations.

How can the quality of information available in manager research technology be considered?

Breadth and depth of researcher capability are factors worth considering. It can be worth asking technology vendors how the researchers who produce the research and ratings output go about their work. Are they stretched thin to cover every potential investment manager, or are they provisioned to dive deep to find the best possible managers within a category? On breadth, it can be helpful to consider the breadth of investment personnel that drive and debate research output, as well as whether specialist research skills married with understanding of real-world client needs and constraints. This is an area that investment consulting and asset owner experience can certainly support.

The business model of the firm is also important. If the business has a pay-to-play model on the research and ratings it undertakes, it is questionable whether the asset manager or asset owner is actually the client. For institutional consulting houses this model is uncommon, however the existence of multi-manager funds management (or OCIO) businesses can raise questions about the independence of research and ratings. With such a business model comes the potential need to defend ideas within in-house portfolios; or perhaps even to utilise the best ideas in such portfolios first, as profitability from the funds under management may be more lucrative than traditional consulting or manager research licensing revenues.

The final word

When choosing a manager research technology provider, or even a consultant to outsource the task, ensuring research is independent and aligned with the best interests of your portfolio is paramount. It is for this reason Frontier Advisors doesn’t accept remuneration from asset managers when providing research and ratings. It’s also the reason why we don’t have an in-house multi-asset management business. Albeit some of our peers also claim to provide independent, non-conflicted investment advice, it’s worth considering whether having an in-house asset management business means research is true-to-label independent.