The results of the 2024 Peter Lee investment management survey have now been finalised with Frontier finishing second overall across all investor types, while retaining our first ranking for large investors and also for superannuation funds.

The survey captures the perceptions of around 100 institutional investors drawn from a range of sectors from superannuation funds through to retail platform providers and financial planning firms.

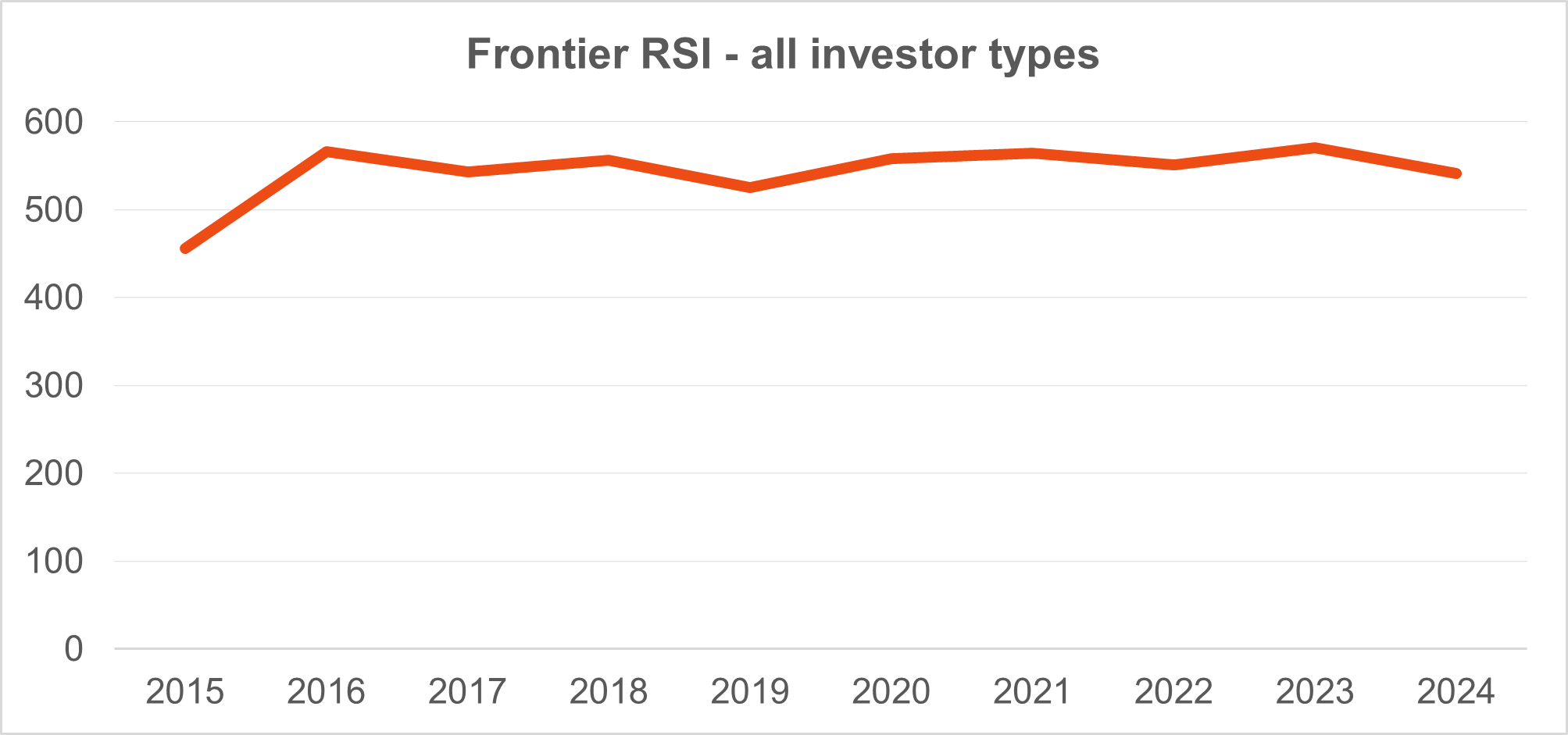

This year’s second ranking in the overall “Relationship Strength Index” (RSI) score, comes after eight consecutive years of ranking first or equal first overall. It is not so much that our score has dramatically reduced this year but rather one other firm’s score in this category has risen. In fact, our RSI has been remarkably constant over the last decade, where other firms have typically shifted or fallen over this time.

In terms of the RSI for ‘large investors’ (over $10 billion in FUM) and for ‘super funds’, Frontier remains the ‘Number One’ ranked adviser.

One metric where we are pleased to have retained a ‘first’ ranking for all investor types, is “performance against agreed benchmarks”. Essentially, when asked if Frontier is delivering against the agreed KPI’s that relate to our engagement, we have been endorsed more strongly than any other adviser. That provides us with confidence that ultimately, we are delivering what is required by our clients at the highest standard. We take great pride in that.

We have also continued to rank ahead of competitors in relation to technology – both our research database and analytical tools. Our continued refinements here (with more to release shortly) are clearly appreciated and valued by our clients.

As the industry evolves, so too does the sample of asset owners participating in the survey. The number of superannuation funds in the survey has now dropped to just 25, due largely to merger activity, while the number of ‘emerging institutions’ in the survey, including providers of self-managed account products, has increased significantly meaning the survey’s profile of investor types now skews toward smaller asset owners. There are just 22 respondents in the survey in the category of “over $10 billion in FUM”. The survey finds that smaller investors typically have a different set of service requirements and expectations, and scope of relationship with their adviser. Our business reflects this evolution as well with our client base also shifting.

Our results across categories for larger investors and super funds have continued to stand up strongly in terms of number one rankings, although we recognise there are a small number of asset consulting firms with a meaningful client presence in these cohorts that the survey can draw on when issuing their rankings.

This year we achieved a first, or equal first, ranking in seven categories for large investors and in nine categories for super funds. This is in addition to our first overall ranking in the RSI for both of these categories.

We appreciate the time taken by our clients who participated in the survey and their assessments. While we are pleased to have continued to score strongly this year, we are certainly keen to create even stronger comparative results over the next year, particularly in the emerging investor categories where our client numbers are steadily growing.