We have published our latest research showing 2024 as the most challenging year for global active equity managers in over two decades. Heightened market concentration and US equity dominance posed significant headwinds, with most managers struggling to meet benchmark returns.

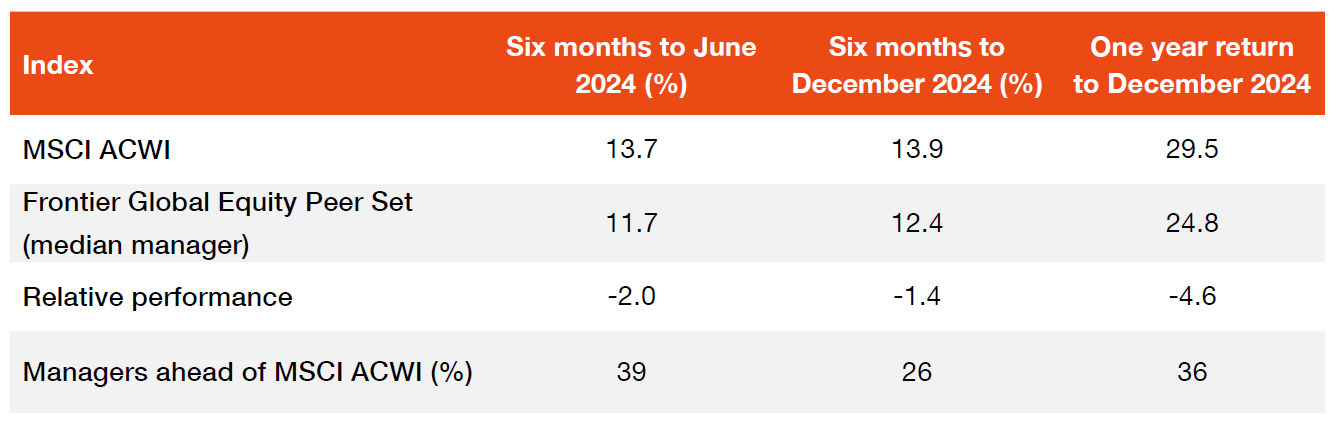

The median global active equity manager underperformed the MSCI All Country World Index (MSCI ACWI) by 4.6%, marking the worst relative return in over 20 years. The dominance of a small group of ‘magnificent seven’ technology stocks, propelled by artificial intelligence optimism, led to a tough year for active management in global equities. As an example, managers who held no position in Nvidia saw a drag of 3.1% on their performance from that position alone. While the MSCI ACWI returned 17.5% (in USD), the median return of the 2,647 stocks in the benchmark was under 1%, highlighting the extreme concentration of market returns. The second half of the year was even more difficult, with only 26% of managers outperforming the benchmark. (Table 1 summarises active management results in global equities.)

Table 1: Frontier Global Equity Peer Set returns against the MSCI ACWI

“This year’s benchmark performance was driven by a small group of stocks, which posed a challenge for active managers,” said Brad Purkis, Senior Consultant at Frontier Advisors. “The two thirds of global active managers who did not hold Nvidia faced significant difficulty in outperforming the broader market, and that’s just one of that group of seven dominant companies.”

We found that quantitative managers stood out as a rare success story, benefiting from diversified portfolios and effective risk controls. Meanwhile, value managers experienced especially challenged outcomes over the year. Growth managers overall outperformed, though market conditions were only conducive to a select group of ‘high growth’ managers with even moderate growth managers failing to beat the benchmark.

“The results show how narrow market leadership and macroeconomic forces can deeply affect active management outcomes,” Brad continued. “Managers with diversified, systematic strategies fared better during this challenging period.”

In the Australian market, strong performance from the big four banks created challenges for active managers, many of whom were underweight in these companies. However, the underperformance of large resource stocks, such as BHP and Rio Tinto, alleviated some of the challenges, leaving the median Australian equity manager only slightly behind the benchmark for the year.

Emerging market managers also faced difficult conditions, underperforming the MSCI Emerging Markets Index by 0.7% for the year. Taiwan Semiconductor Manufacturing Company (TSMC), which saw a return of over 90% in 2024, posed particular challenges for managers holding underweight positions relative to its >10% benchmark weight. Even an absolute weight of 5% (half the benchmark weight of 10%) in TSMC would have dragged returns down by about 4%.

“Emerging markets provided little relief for active managers,” Brad observed. “TSMC’s dominance meant that underweight positions were difficult to overcome for many managers.”

As 2025 unfolds, investors and asset owners are cautiously hopeful for improved conditions for active management with the opening weeks of the year providing a very strong start for active investors in global equities. However, ongoing US equity dominance, concentrated markets, and macroeconomic factors continue to influence the investment landscape.

Our research paper released to clients earlier this month delves deeper into the underlying factors that have contributed to outcomes in global equities. To support this analysis, our Equities Team curates detailed peer sets within both Australian and global equity markets to help better understand and provide valuable insights into the performance of active managers across various style classifications.