The Australian Prudential Regulation Authority (APRA) has finalised the new capital framework for private health insurers (PHIs), with new regulations coming into effect on 1 July 2023.

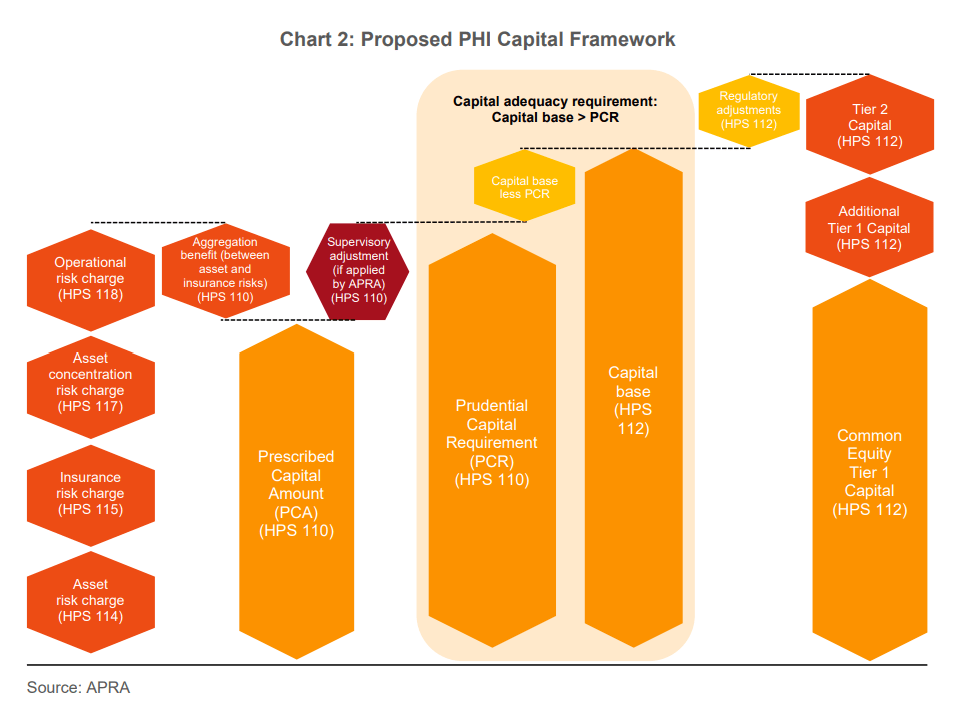

APRA recognises the introduction of a new capital framework is a significant change for the industry and has offered insurers an optional two-year transition period to meet the new prescribed capital amount (PCA) and capital base requirements. Certain eligible insurers will also be eligible for a twoyear exemption from the new Internal Capital Adequacy Assessment Process (ICAAP) requirements.

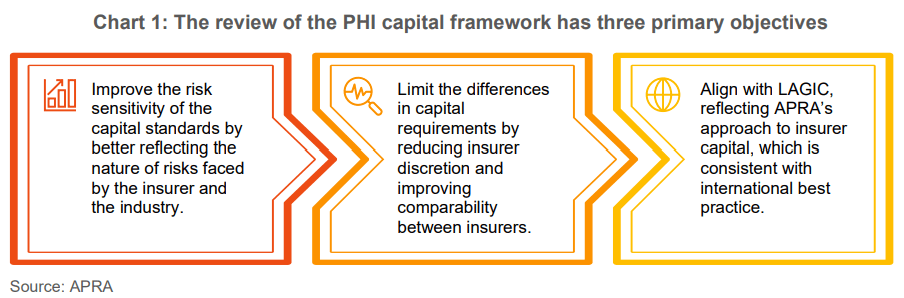

The aim of the new capital framework is to ensure the industry maintains an appropriate level of financial resilience. In summary, APRA believes “the new standards strengthen risk sensitivity, improve comparability across insurers, and align with APRA’s capital framework for life and general insurers (LAGIC) which is consistent with international best practice.”

The new capital framework consists of separate charges for insurance risk, asset risk, asset concentration risk and operational risk, alongside an aggregation benefit when combined. There is also provision for supervisory adjustments, and APRA can determine adjustments to the capital required.

Overall, APRA believes the changes improve the coverage of risk by applying a capital charge on asset risk and asset concentration risk outside the health benefits fund; and help manage risks related to non-insurance businesses via the ICAAP. The new framework also aligns with the introduction of AASB 17 for prudential purposes.

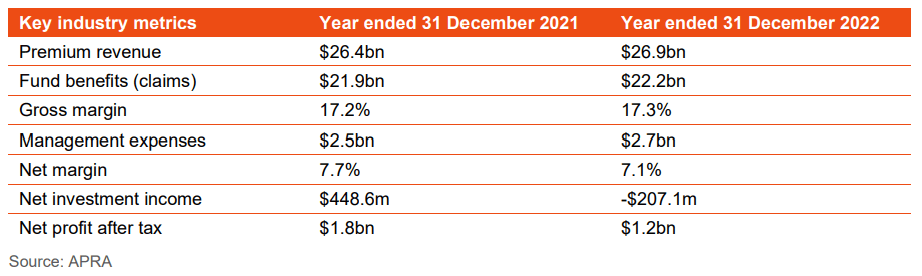

Following a challenging period for the industry, recent experience has been more positive after the COVID-19 pandemic which caused many people to reassess their need for private healthcare coverage. This has resulted in rising participation levels following many years of declining coverage, especially among younger policyholder cohorts. Pandemic restrictions also led to fewer policyholder claims and a reduction in the amount of benefits paid out. However, with many PHIs having vowed not to profit from the pandemic, much of the pandemic related profits have been returned to policyholders via premium reductions or direct payments.

As part of the consultative process ahead of the introduction of the new standards, several insurers raised concerns around the potential negative impact on their capital requirements and business model, which they believed would unavoidably lead to higher premiums for policyholders. They flagged the new standards would potentially increase target capital levels, with the additional capital likely to be sourced through net profits and ultimately from premium income.

Other insurers also noted the impact of the higher capital charge associated with ‘growth’ assets in the Asset Risk Charge (ARC) which may force them to further de-risk what are already relatively low risk portfolios. Many insurers use their investment portfolio to supplement premium income and manage net profits, allowing them flexibility to offer greater value to policyholders, for example through reduced premiums or higher benefits.

In response, APRA has stated the industry remains well capitalised (under the final standards, it is expected the total industry PCA will be around $3.5b and the capital base around $8.6b) and APRA is not of the view the increase in minimum regulatory capital requirements provides a basis for increasing premiums. Equally, APRA does not consider that changes in investment strategies will be needed.

In 2021, investment income across the industry accounted for nearly 20% of net profit before tax. While in 2022, volatility in investment markets led to an industry wide investment loss of $207m, contributing to a 33% reduction in net profit after tax.

It is clear investment income is a core part of PHI profitability and will be important on an individual company basis. The potential impact of the new regulations on PHI’s investment strategies is a valid concern, especially for those where investment income is a larger contributor to profitability. However, we believe it is possible for PHIs to ensure their investment portfolio is capital efficient while still preserving the desired level of risk and return to remain competitive within the industry and continuing to support their wider business objectives.

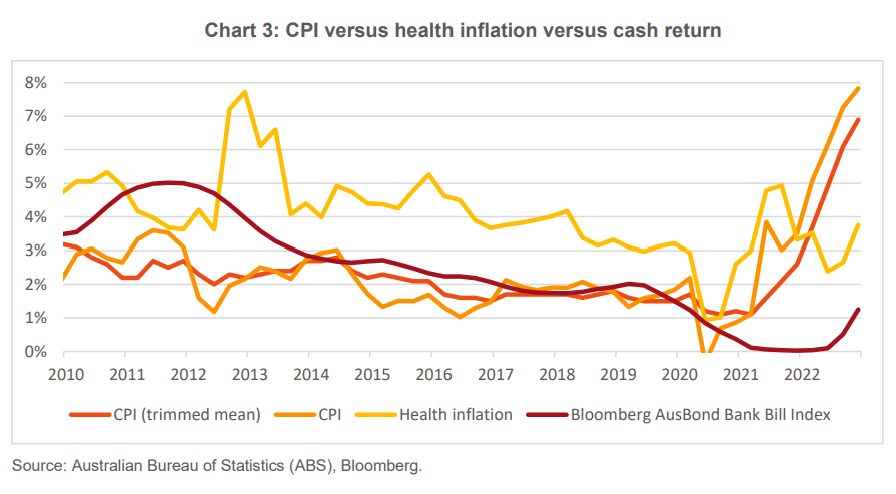

PHIs typically take a conservative approach to managing assets backing their insurance liabilities – holding highly liquid cash and other short-dated, high-quality credit to back the very short-tail liabilities. However, surplus capital is often invested in more return seeking assets to support wider strategic business initiatives and to provide flexibility, as noted above. Further, a PHI’s insurance portfolio is exposed to the inflation of health-related costs which typically rise at a rate above standard inflation measures. Achieving a stable and real return (at least above CPI but ideally also above the level of superimposed inflation) is important in ensuring the real value of the PHI’s capital base is maintained over time. Particularly considering one mechanism for increasing capital over time (via future premium increases) is subject to government approval on annual basis, potentially limiting the ability for a PHI to improve or repair their capital position through organic growth.

Focusing on the asset or investment side of the balance sheet, the new capital framework creates a trilemma for PHIs, where risk (including liquidity risk), return and capital charges need to be balanced. Portfolio construction and asset allocation decisions need to consider each of these dimensions and PHIs need to determine which aspect they consider to be their primary objective in designing and implementing a robust and capital efficient investment portfolio.

Learn more

Frontier Advisors has extensive experience working with a range of regulated insurers, including health, general and life, and aiding them in designing and customising diversified portfolios to meet their needs and find the ideal balance across these competing objectives.

We have a team of consultants dedicated to working specifically with our liability-driven investor (LDI) clients. This team has a blend of actuarial and investment qualifications and experience and works closely with our in-house technology team to develop and refine tools tailored for managing LDI portfolios.

Please contact our dedicated LDI team if you would like more information on how we can work with you to prepare your portfolio for the impact of the new capital standards.