Introduction

Interest in natural real assets has increased among institutional asset owners seeking opportunities for diversification and investments that not only deliver financial returns but also create a positive environmental impact.

Frontier uses ‘natural real assets’ as an umbrella term that includes timber, agriculture and Australian water rights. Despite the increased use of the term ‘natural capital’ in investment management, we have purposely avoided it due to the lack of clarity on what the term means as an investment asset class and to avoid confusion with other uses of the term in resource economics.

We have continued to group timber, agriculture and water under the term ‘natural real assets’ due to their many shared characteristics, substantial overlap in the required manager skill sets and increased investor interest. For example, agriculture and timber require deep knowledge of international trade; supply chains; supply and demand dynamics; and a scientific and environmental capability to oversee the production operations. Similarly, Australian water, agriculture and timber managers need to have a detailed understanding of weather and climatic patterns, agronomy (i.e. the science of agriculture) and the effects of climate change to effectively manage their assets.

Frontier’s previous research into investing in timber identified the sector as relatively large, with a greater range of managers and strategies available and potentially lower volatility compared to agriculture. In contrast, we found agriculture had attracted less capital and was more varied, but also offered higher expected returns and greater growth potential. Our 2017 paper Frontier Line 129: Timberland and Agriculture: A Primer saw agriculture as the more compelling investment opportunity of the two sectors, leading to another research paper on the sector in 2019: Frontier Line 144: A Case for Agriculture.

Since then, allocations to Australian agriculture and water entitlements have continued to grow, most notably from offshore institutional capital (e.g. PSP, OTPP, AIMCo), as North American pension funds sought to access lowly correlated returns, positive environmental impacts and value-creation opportunities through improved productivity of assets and businesses. Similarly, there has been a renewed interest in timber as the harvest of carbon credits along with lumber becomes a more explicit feature of investment strategies.

This paper is an excerpt of our extensive new research paper, Opportunities in natural real assets, which covers:

- Key attractions of natural real assets investing.

- The performance, return drivers and investment options of timber, agriculture and water.

- Allocation considerations and our views.

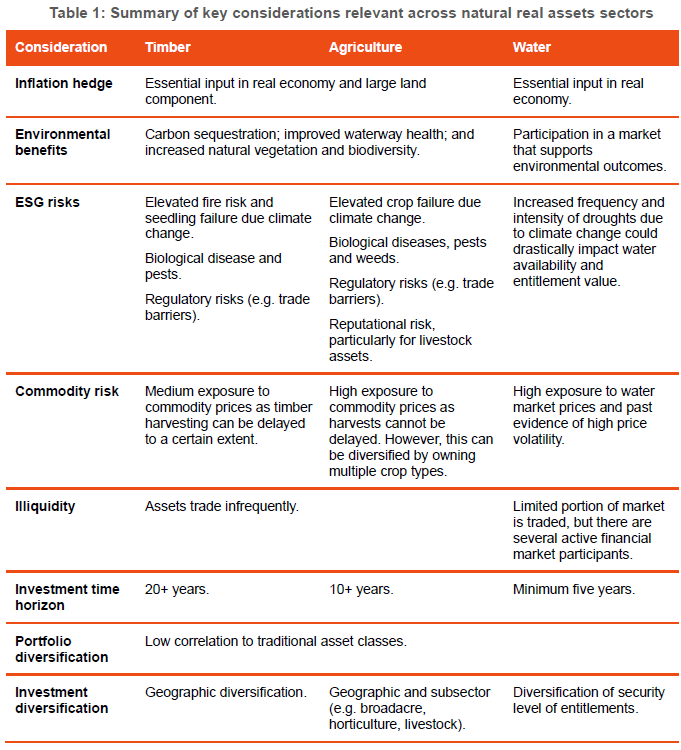

Key considerations relevant across natural real assets sector

The natural real assets sectors can offer diversification, inflation-linkages and opportunities through productivity gains and fundamental drivers, which are underrepresented in broader investment portfolios. However, given the differentiation of natural real assets from other asset classes, there are considerations which should be weighed carefully by asset owners. Table 1 highlights the key consideration for asset owners.

There are also barriers to investing in natural real assets, which we have identified in the comprehensive version of this paper. In our 2022 paper Super in the Economy, we outlined several key impediments to investment in natural real assets, with a focus on Australian agriculture. Those that remain most pertinent today are:

- Lack of information/transparency: Benchmarks lack scope and access to representative data is challenging.

- Skills and knowledge gap: Understanding of natural real assets sectors in the broader investment community remains limited.

- Reputation considerations: Social licence to operate is important to consider and some segments of natural real assets are subject to negative sentiment from certain public groups.

- Difficulty achieving diversification: Scale of natural real assets sectors can make this challenging, but it is an important consideration for a portfolio.

- Illiquidity: Assets trade infrequently, markets are relatively small.

ESG factors and ‘nature positive’ outcomes – what’s the difference?

Asset owners need to distinguish between the management of ESG risk factors and ‘nature positive’ outcomes in natural real assets. The former is a risk management approach for the purpose of optimising risk and return, whereas the latter can be an outcome in its own right.

ESG factors

Recently, interest in natural real assets has been driven by an increasing focus from asset owners seeking exposure to the potential environmental benefits on offer. Managers’ social license to operate relies on strong environmental management, sustainable business models and engagement with local communities, which are often deeply integrated into the natural real assets industries. Without a strong environmental lens, natural real assets managers will expose themselves and their asset owners to the financial, regulatory and reputational risks associated with poor environmental management and negative social outcomes.

When managed responsibly, investments in these sectors have the potential to achieve both positive environmental and social impacts alongside financial returns. This is most pertinent to the timber and agriculture sectors, where managers are incentivised to maintain and enhance their natural environments, given this can directly contribute to the productivity and value of their assets. An example from agriculture is implementing regenerative cropping practices including low-tilling methods, crop rotation and optimisation of natural nitrogen-fixing. These can increase crop yields, reduce fertiliser input and improve soil water retention which lowers input costs and increases revenue and earnings.

Nature-positive investing

Some asset owners may be focussed on enhancing environmental outcomes as part of an impact investing framework. Regarding natural real assets, such activities are often described as enhancing essential ‘ecosystem services’, which can occur via carbon sequestration, improved waterway health, native revegetation and supporting biodiversity. The focus of asset owners in delivering these benefits has been coined a ‘nature-positive’ approach to investing.

To meet asset owners’ expectations, we expect managers will increasingly adopt the recommendations released by the Taskforce on Nature-related Financial Disclosures (TNFD) to assess, measure and report on their nature-related impacts, dependencies, risks and opportunities in a systematic manner. The Clean Energy Finance Corporation (CEFC) has considered various frameworks including the TFND to develop its guidance on measuring environmental impact in agricultural investments.

Positively, we recognise managers and corporations operating within timber and agriculture can effectively manage risks and often enhance returns through improved practices, which can also deliver positive impacts. However, we believe asset owners should be prudent when managers are promoting ‘nature-positive’ outcomes noting the level of ‘impact’ may vary widely.

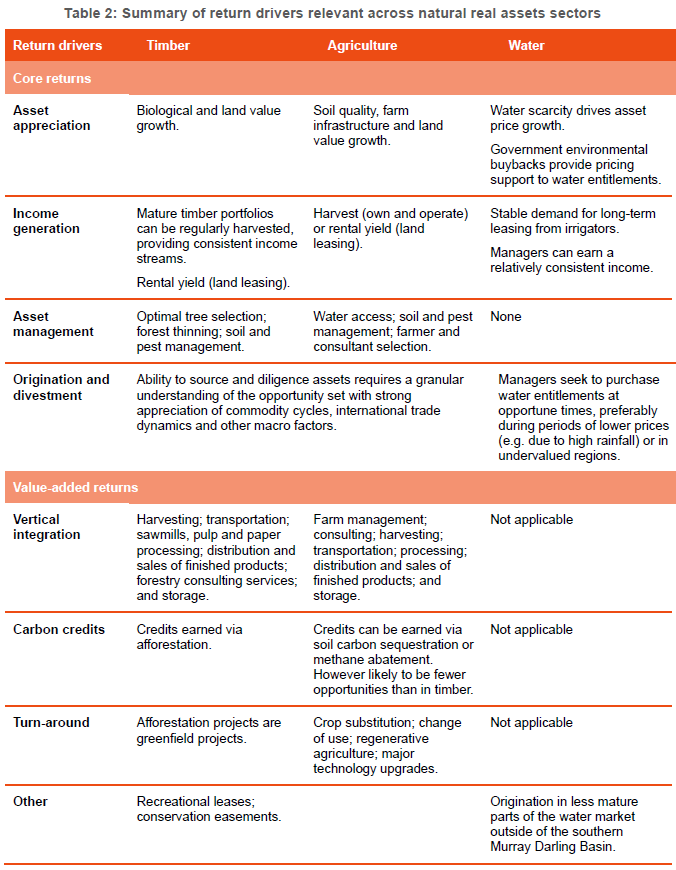

Return drivers

Natural real assets provide a unique combination of return drivers including biological growth, weather, commodity supply and demand dynamics and land values. These unique drivers provide natural real assets investments with significant diversification benefits, exhibiting low correlations with other asset classes.

Investment considerations

With the growth of the timber, agriculture and water asset classes, a broader product set has become available to asset owners. This ranges from income and land appreciation-focussed core strategies to business growth/private equity-style funds with substantially different approaches. The comprehensive version of this paper presents the broader opportunity set and clarifies the investment considerations pertinent for institutional asset owners considering an allocation to natural real assets sectors. These considerations include diversification, risk profile, value drivers and the potential return-enhancing opportunities within portfolios. Despite the challenges asset owners face in natural real assets, Canadian pension fund, PSP has built strong internal investment capability and large diversified portfolio of assets. PSP’s portfolio (view downloadable paper) is illustrative of what is possible via a long-term, well-funded and dedicated natural resource capability.

The final word

Investment in natural real assets presents an opportunity for asset owners seeking diversification, long-term allocations, and positive environmental impacts in addition to financial returns.

Timber has a respectable long-term track record; agriculture managers have demonstrated strong performance; and while water remains a relatively niche sector, performance has also been strong, but not without volatility.

Notably, certain timber and agriculture managers are enhancing their investment strategies to deliver positive environmental impact to ensure long-term business viability, and therefore, long-term financial performance. For ‘nature-positive’ investments, asset owners require expertise to quantitatively define those positive impacts; investment expertise to understand return impacts; and manager research expertise to fully assess managers’ capability to measure impacts specifically. We can assist clients with this assessment and how it fits into a broader impact investing framework.

Given the high level of exposure to ESG risks in natural real assets investing, managers must demonstrate a strong capability to avoid, mitigate and/or manage these risks. Frontier has a robust ESG assessment framework to assist asset owners adjudicate on managers’ ESG capabilities.

Our Real Assets Team has met with numerous managers across the natural real assets sectors and has the expertise to assist small and large asset owners consider the unique attributes and complexities of these sectors. We can assist clients who wish to undertake comprehensive due diligence on natural real assets investments including advice on the benefits, considerations and avenues to allocate.

Access the full paper

Our comprehensive paper analyses the returns of timber, agriculture and water, highlighting their distinct return profiles and sector-specific complexities that asset owners should consider. We also provide recommendations on how to allocate.

If you have any questions or want to access the full paper, please contact your consultant or our Real Assets Team. Clients can access the comprehensive research paper on Partners Platform.