Digital infrastructure had developed a track record for offering attractive investments and strong, steady returns before the COVID-19 pandemic. However, the sector rose to prominence during the pandemic, given society’s total reliance on digital communications and processing for all its needs including work, education, shopping and leisure. The secular tailwinds driving data consumption growth in the sector have been prevalent for some time. However, these accelerated during and after the pandemic, leading to digital infrastructure becoming an indispensable utility. Such rapid and total reliance creates an obligation for digital infrastructure to keep society and the economy functioning. As communications technology has evolved, so has the investment landscape and historical investments in satellites and integrated telecommunication networks have given way to a new wave of investment in three popular sub-sectors of:

- Optical fibre networks, driven in part by government incentives for higher bandwidth under the EU Green Deal and US Inflation Reduction Act (IRA).

- Data centres, driven by migration of data networks to cloud computing and of late, by development in artificial intelligence (AI).

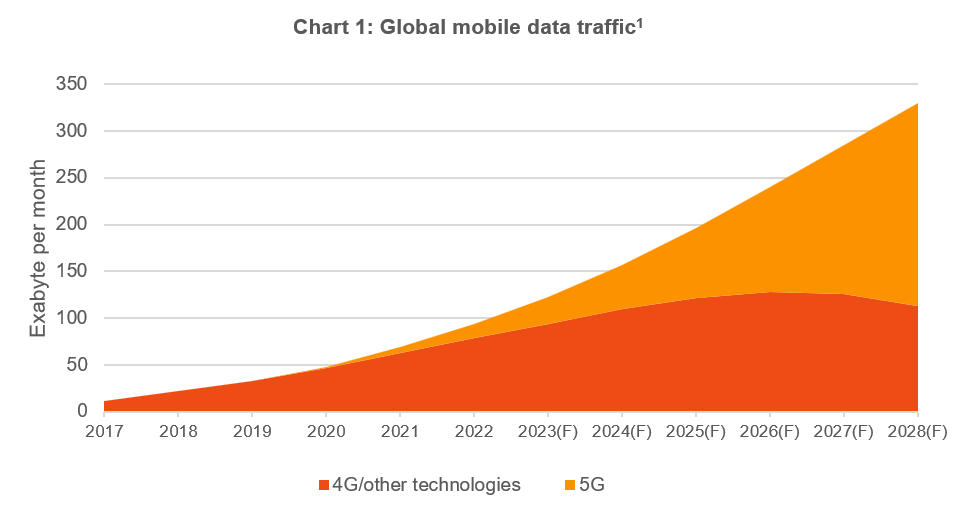

- Mobile towers, driven by deployment and expansion of 5G mobile networks.

Investors’ appetite for digital assets is evident in the recent growth in the digital infrastructure transactions. The Frontier-tracked universe of infrastructure managers allocations to digital asset has grown from 3% in 2018 to 9% in 2023.

Frontier has written an extensive research paper focusing on the three key sub-sectors identified above and the thematics driving their investment thesis including:

- The relentless growth of data storage and transmission (see Chart 1 for mobile data growth).

- Developments in the application of AI leading to a step change in demand for AI-capable data centres.

- The need for in-fill tower sites to provide greater mobile data bandwidth to consumers.

- Institutional investors’ focus on the environmental impact and carbon emissions of their assets.

- Due diligence factors, specifically technology assessment, to consider for digital infrastructure investments.

- An analysis of valuations trends transacted in the sector and assessment of current valuations.

Digital infrastructure is a proven sector for investments having demonstrated resilient demand, growth tailwinds and returns before and during the COVID-19 pandemic. The sector was once favoured by private equity but has since attracted infrastructure investors with abundant opportunities across sub-sectors such as fibre networks, mobile towers, data centres, fixed-line networks and even integrated telecommunication companies. Frontier believes digital will remain a fertile sector for investors over the long-term. The positive trends of increasing digitisation across societal needs, proliferation of AI and hybrid workplaces will continue to drive demand for data and foster innovation for new digital products, which in turn will drive capital and investment into existing and new digital infrastructure.

Our paper provides a guide on how investors can access the investment opportunities, while also reviewing recent market transactions and valuations trends.

Learn more

Frontier has researched the digital sector for an extended period. We have rated strategies and maintain relationships with a variety of managers that provide access to core, core plus and value-add digital infrastructure assets. Our Real Assets Team has the expertise to undertake comprehensive due diligence in the digital sector and is well placed to advise investors on the benefits, pitfalls and access methodologies.

To receive the full report please email frontier@frontieradvisors.com.au

Frontier clients can access the report through your Partners Platform subscription.