Frontier recently revisited our 2019 deep dive of the office sector in Australia (looking at the bottom-up fundamental factors driving current and future valuations).

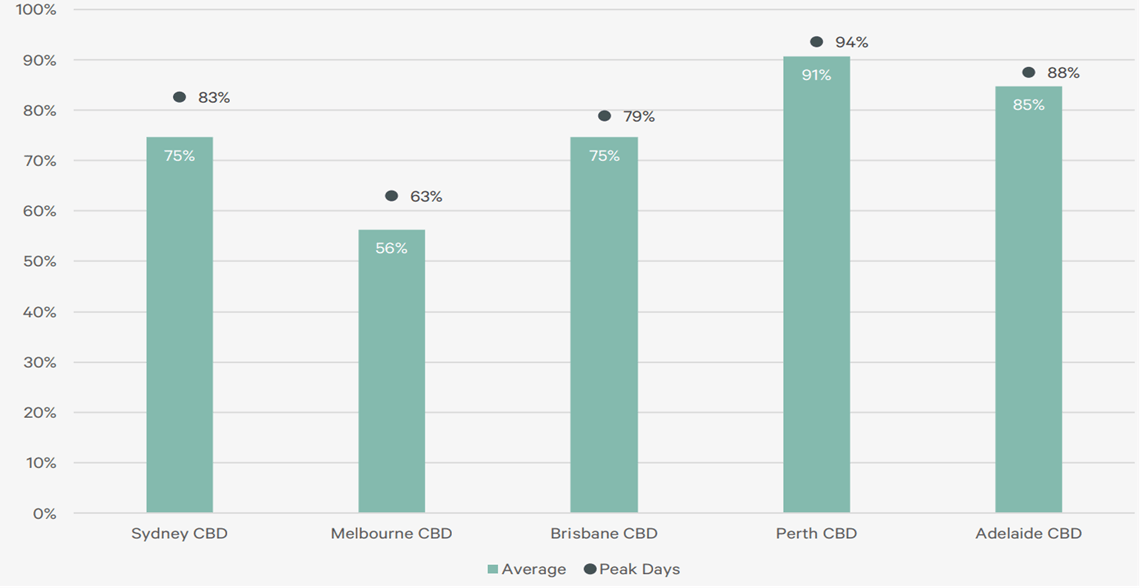

Much has emerged since then, most notably COVID-19 lockdowns leaving indelible memories and work preferences, particularly for Melburnians. The results are clearly discernible and differentiated responses to working styles have varying impacts on office demand. Hybrid working is here to stay – Melbourne is a clear leader. Unsurprisingly, we observed that apart from Melbourne, most cities have returned to somewhere between a 75% (Sydney) to 91% (Perth) in office attendance. This is supported by CBRE research as shown in Chart 1 below.

Chart 1: Australian office occupancy by CBD market in Q3 2023

Our approach

- We surveyed invested managers and key portfolio metrics including lease expiries, rental growth rates, CAPEX budgets, customer (corporate tenants) preferences and trends and vulnerabilities for the office sector in Australia to ongoing work from home (WFH) trends and artificial intelligence (AI).

- Assessed current and future office supply versus demand for key cities of Sydney and Melbourne: future absorption, vacancy rates – current and future leasing incentives.

- Frontier considered the introduction of AI and the potential related job losses in certain industries and net productivity gains.

- Migration effects on job growth in the sector, usually positive for white collar employment.

- Demand for highly credentialled, sustainable buildings versus economic obsolescent buildings.

- We ran regression analysis of key inputs: supply, demand and net effective rents (NEF); discounted cash flow (DCF) analysis over a ten-year horizon including base, upside and downside scenarios and sensitivity analysis.

Results of our analysis

Frontier has produced an extensive paper and analysis of the market – including measuring our base case and various factors (and the size impact of those factors) which may lead to various upside or more extensive downside scenarios.

The analysis in Frontier’s detailed report shows that the office sector faces uncertainty. WFH impacts have not fully washed through the corporate response, with right-sizing proving the biggest challenge for all stakeholders.

Valuations have lagged both global counterparts (and listed markets) where adjustments are a stark contrast to the UK and US. We expect circa two to three more quarters of cap rate (and discount rate) expansion, meaning more write-downs for the Australian office sector.

In the meantime, we observe a move towards more flexible use of office space and lease terms, often in relating to business expansion and/or contraction. We view this as a shorter-term adjustment rather than a sweeping structural trend. Melbourne CBD is more prone to supply shocks given more land availability at cheaper-than-Sydney pricing.

The final word

While the correction in office market fundamentals is likely to reduce returns over the medium term for the office sector, we believe there is a place for highly credentialed property assets with strong income yields in a portfolio.

Furthermore, we have been advocating needs-based sectors as strong diversification in real estate portfolios. Global real estate investment trusts (GREITs) can fill this gap. As global bond yields depreciate, GREITs rally and given the large discounts in public markets, we think this provides a sound opportunistic strategy.

Learn more

Our Real Assets Team can undertake a portfolio analysis of your office sector and provide alternative recommendations. Get in touch if you would like to discuss elements of the detailed report.

To receive the full report please email frontier@frontieradvisors.com.au

Frontier clients can access the report through your Partners Platform subscription.