In October 2024, Frontier’s property and debt research teams conducted a research trip to the US, engaging with managers to gain insights into the dynamics of property debt investments. This paper discusses key observations, examines considerations for investors and explores how property debt can contribute to a portfolio at different stages of the real estate cycle.

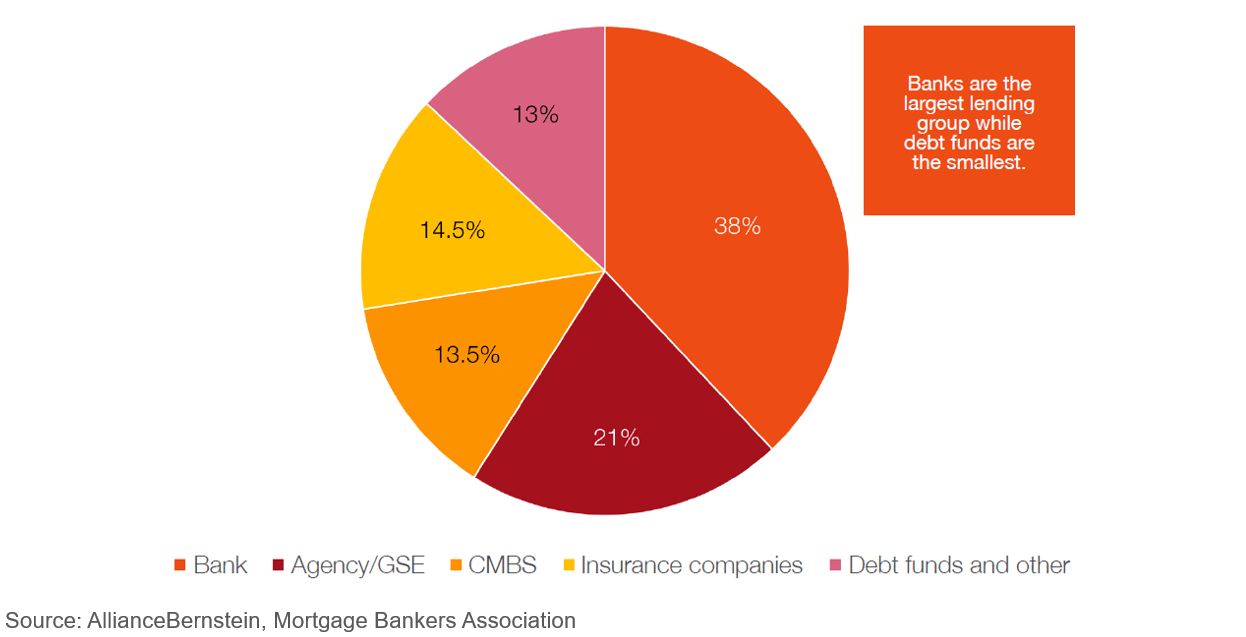

The US property debt market, valued at approximately US$4.5 trillion, is significantly larger than the current market capitalisation of Australia’s stock exchange. However, property debt funds remain underrepresented, making up for only about 10-12% of the total market (see Chart 1). This presents opportunities for debt funds to gain market share, especially as banks and insurance companies reduce their lending activities.

Chart 1: Composition of lenders in the US property debt market

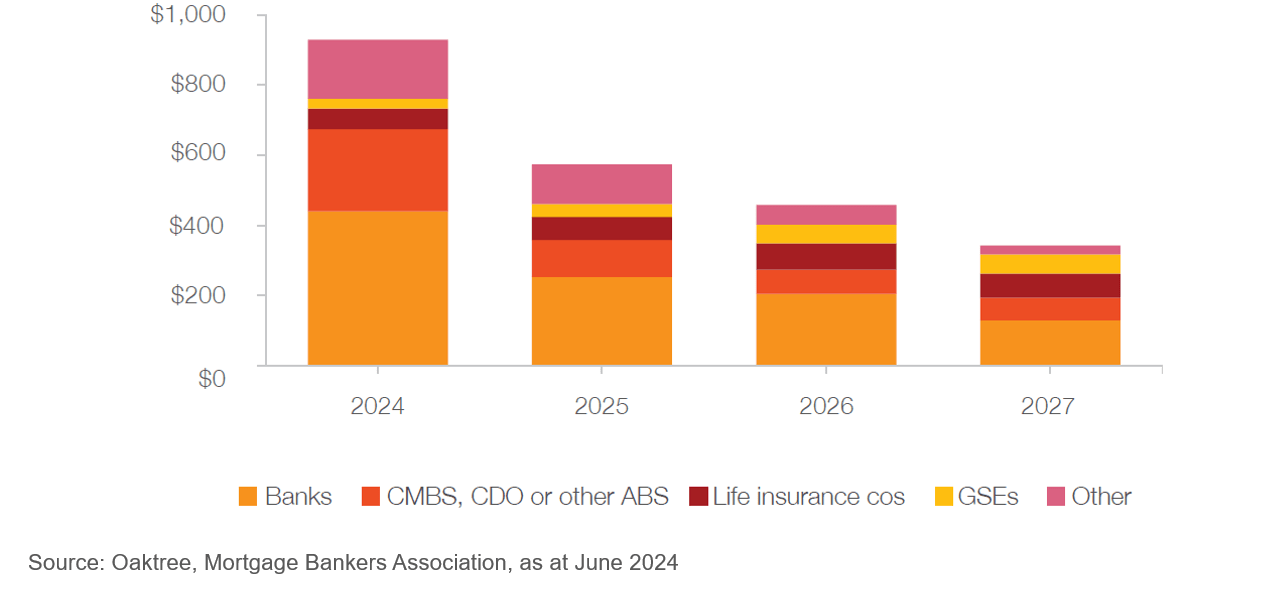

A notable trend is the increasing demand for property debt financing, driven by a significant volume of loans maturing between 2024 and 2027 (Chart 2). Another key development in the property debt market has been the pull back of banks. Banks have reduced their property lending since 2022, providing an opportunity for debt funds to access more attractive deals with better terms. The withdrawal of banks is expected to continue, particularly due to the over-exposure of regional banks to property debt, as well as new regulatory requirements under Basel III, which could further limit banks’ property lending.

Chart 2: Maturity wall – US property debt market (US$billion)

Managers typically focus on sectors such as multifamily, industrial, student housing, senior living and medical offices, with an emphasis on areas with strong demand fundamentals. The office sector remains a concern, with managers very selectively lending to modern high-quality offices supported by proven demand. Despite challenges in the US property market over the past three years, property debt investors face a low risk of significant property value declines going forward, as the interest rate hike cycle is likely to have ended and oversupply in certain sectors is expected to be balanced within the next 18-24 months. While the future path of property prices is uncertain, most managers believe the worst of the price decline has passed, with signs of stabilisation and recovery in certain sectors.

We have observed managers actively mitigating risks through a combination of strategies. A key protection is ensuring loans have a substantial equity cushion, typically in the range of 25-35%, lowering the risk of loss in case of default. Additionally, loan terms, such as amortisation schedules and covenants, help protect lenders. Diversifying portfolios by sector, geography and sponsor is another key strategy, allowing managers to target high quality assets while avoiding high-risk sectors like office and certain retail properties.

Currently, property debt offers attractive returns, with higher credit spreads and more favourable loan terms for lenders compared to 2021-2022. Credit spreads have widened by 50-200bps, and the valuation in loan-to-value ratios have adjusted in line with lower property values. This has created an opportunity for investors to earn higher returns with lower risk. Construction loans have become more attractive as small US banks, which once dominated this market, face reduced lending capacity due to their over-exposure and constrained lending appetite following the 2023 regional banking crisis.

Want to learn more?

Frontier has long advocated that property debt can have a role within an investor’s property portfolio. This research trip has reconfirmed this view. We believe at this juncture property debt is particularly relevant for investors looking to deploy capital in a risk measured manner.

For investors considering an allocation to property debt, the due diligence on existing loan pools is critical to ensure there is no exposure to existing troubled loans. Where appropriate, an allocation to a new vintage is preferred to avoid exposure to the stressed property sector and benefit from sectors with strong fundamentals. In either case, investors should partner with managers with proven experience and expertise to successfully manage the risks.

We have been in dialogue with a broad range of managers and there are a multitude of strategies with different risk/return profiles that could meet the different needs of investors. We would be pleased to work with clients to consider portfolio requirements and find solutions tailored to client specific needs and requirements.

If you have any questions or want to access the full paper, please get in touch with us. Frontier clients can access the comprehensive research paper instantly on Frontier’s Partners Platform.